At the University of Portsmouth, our insurance policies are designed to cover a broad spectrum of activities, ensuring peace of mind for our staff, students, and corporate partners. Whether it's for educational purposes, research endeavors, or trading activities, we've got you covered.

This page provides a snapshot of our key insurance policies, offering a general overview of our coverage.

If you would like to know more, get in touch with us.

Insurance policies

We provide travel insurance at no additional cost for staff and students travelling overseas on approved University trips for travellers up to the age of 75.

The policy covers those studying or working abroad for up to 1 year.

This insurance provides comprehensive cover including:

- Unlimited Emergency Medical Expenses (including Covid related medical expenses)

- 24 hour assistance helpline

- Baggage cover, including laptops

- Cover if forced to cancel trip or return home early

- Personal liability cover if you are sued

- Personal Accident cover

There is a £50 policy excess for most claims.

Evidence of Insurance for Overseas Trips

AIG is the appointed University Insurer. Evidence of cover for visa purposes can be found below:

The full policy wording and policy schedule detail all terms and conditions.

Emergencies and claims

Healix International are appointed to provide assistance in the event of an emergency (e.g. accident, illness, lost travel documents, political unrest)

The best way to contact Healix is through the Healix Sentinal Travel Oracle App. Alternatively please call the operations centre on +44 (0) 2080 573 958.

If you do not have a mobile signal, they can be E-mailed at hih@healix.com. Please quote the University of Portsmouth.

How do I make an insurance claim?

Please E-Mail insurancesupport@port.ac.uk for further information.

Are there any countries where I am not insured to travel?

Approval is required from the University Travel Insurers and the Deputy Vice-Chancellor (Global Engagement and Student Life) prior to booking any travel to regions where the Foreign and Commonwealth Office advise against all; or all but essential travel; or Healix advise to evacuate or consider evacuation.

This includes travel plans which go via any of these countries, i.e. flight refuelling stops, connecting flights etc.

In addition, our insurers have provided a list of destinations whereby supplementary information is required for sanctions compliance purposes.

Who are Healix and what do they do?

The University has secured the services of Healix to provide to provide advice and support to travellers in the event of an emergency (e.g. accident, illness, lost travel documents, political unrest).

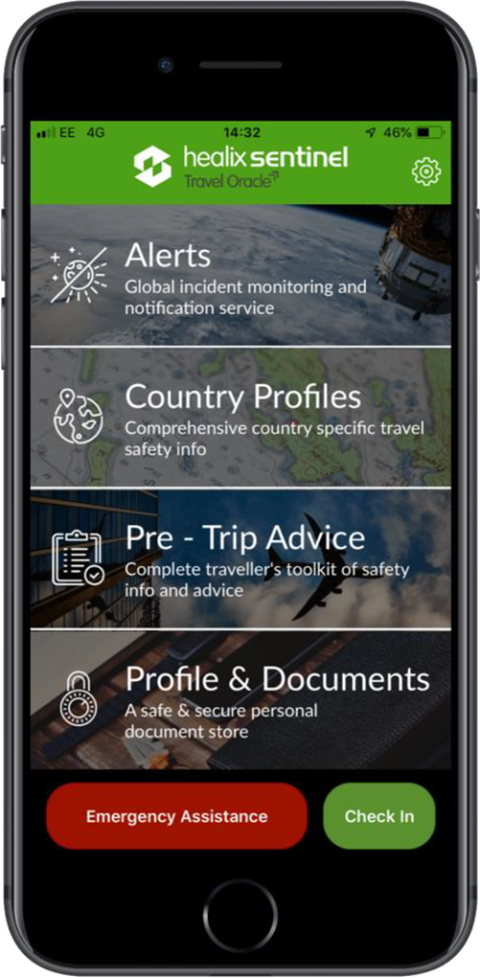

For duty of care reasons, prior to departure, all travellers on University business are required to download the Healix Sentinel “App” to receive advice and support whilst travelling.

Whilst abroad we recommend that travellers switch on the GPS tracking on the “App” whilst in use so that active monitoring of risk in that country can occur and support provided if the situation presents a risk.

How do I contact Healix in the event of an emergency?

The best way to contact Healix is through Emergency Assistance red button on the Healix Sentinal Travel Oracle App. This will start a call to the 24/7 Operations Centre by generating a phone call to their assistance number +44 (0) 2080 573 958

How do I download the Healix Sentinel Travel Oracle App?

Healix has produced a guide which explains how to download the app. This document is staff-facing only. If you are a student, all the information you need is on the student overseas travel guidance.

Please ensure that you add your University E-mail address and mobile phone number as in the event of an incident overseas, this will provide Healix with alternative methods to get in contact and provide support.

Incidental Holiday Guidance

Sometimes insured people will request extensions to their travel insurance to provide cover for holiday trips in conjunction with formal trips for work or exchange.

Insurers consider it reasonable to extend a business trip, before or after the trip for a number of days depending on the duration of the business trip. For example if there was a trip to Paris commencing on a Wednesday it would be fine to extend the stay over the following weekend or travel a few days early including stopping off en-route either to or from the trip.

Incidental days does not intend to accommodate what would normally be considered to be stand-alone holiday cover, or personal travel to a different country where you are undertaking university business. The following guide may be used, but to discuss any particular trip details you are unsure about, please contact insurancesupport@port.ac.uk.

The number of holiday days that can be taken according to business trip length is as follows:

- 0 holiday days on a business trip of less than 5 days

- 2 holiday days on a business trip of 5–12 days

- 5 holiday days on a business trip of 13–21 days

- 8 holiday days on a business trip of 22–35 days

- 12 holiday days on a business trip of 36–50 days

- 16 holiday days on a business trip of 51–65 days

- 20 holiday days on a business trip of 66–80 days

- 23 holiday days on a business trip of 81–100 days

- 25 holiday days on a business trip of 101–365 days

- 28 holidays days on a business trip of over 365 days

There is no cover for pure holidays or for accompanying friends and family member whereby personal travel insurance arrangements will need to be made.

If you're thinking of skiing or snowboarding during your time abroad, you may wish to consider buying a specific Winter Sports Travel Insurance policy.

This is because the University travel insurance will not cover:

- the cost of hiring equipment if yours is lost, stolen or damaged

- replacement ski passes

- compensation for piste closures

- cover for avalanches (transport and accommodation)

In addition, it will not cover going off-piste, competitions or extreme sports.

Some destinations around the globe have specific insurance requirements for international travellers, whereas traditional insurance will not be accepted and comprehensive medical insurance will be required.

These requirements usually form part of visa applications and vary from country to country.

For example, from 1st February 2023, Qatar instructed new entry requirements, in that only Medical Insurance purchased from a select panel of local Takafu insurers will be accepted.

Certain EEA states now require travellers to purchase Private Medical Coverage where the stage is more than 90 days.

We purchase Employers Liability, Public Liability and Professional Indemnity insurance to cover the wide range of University activities our staff and students are a part of:

You should look for this document if you need evidence of the our liability insurance arrangements, such as working with research collaborators, exhibition organisers, visitors or schools who are asking us to host work experience students.

Important Information for Claimant Solicitors

We expect that notification of claims from Solicitors or Claimant Representatives will be sent by an electronic Claim Notification Form (CNF) submitted direct to our Insurers through the Department of Justice Claims Portal.

Portal Compensator ID: D00019

The University purchases comprehensive insurance for all University owned, hired or leased vehicles whilst used in the UK.

Hire companies or other authorities who require evidence of our insurance should view the Motor Insurance Certificate: